QuickBooks® Instant Sales Tax

The Best Solution for Instant Payment Processing in QuickBooks®

Today Payments is an Authorized Developer of Intuit offering a highly robust app that supports both QuickBooks’ desktop and online customers, provide merchants with the tools they need so they can focus more time on their customers and businesses, and less time on data entry.

"Our Integrated payment solutions can save a typical small business owner more than 180 hours each year"

See

the features

QuickBooks® ACH, Cards, FedNow and Real-Time Payments

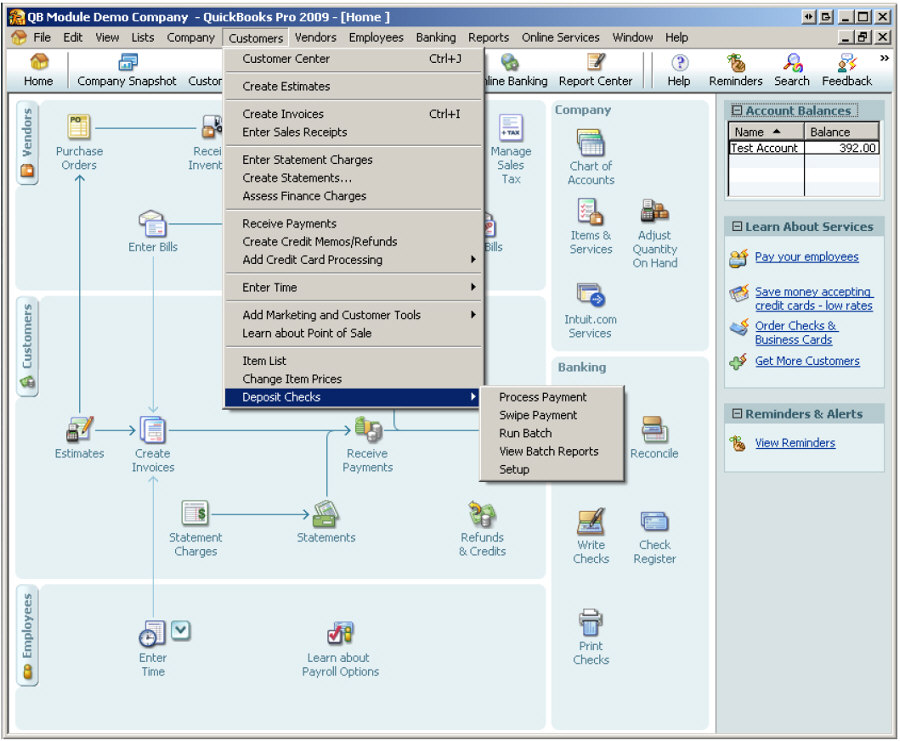

- Payment processing for all QuickBooks desktop, Pro, Premier, Enterprise and also QBO QuickBooks Online Our software is designed for simplicity and ease-of-use.

- ~ Automate Account Receivable Collection

- ~ Automate Account Payable Payments

- ~ One-time and Recurring Debits / Credits

Secure QB Plugin payment processing through QuickBooks ® specializes in the origination of moving money electronically.

Ask about our special:

Request for Payments

Integrating instant sales tax remuneration and reporting into QuickBooks Online (QBO) for various sales channels (POS, MOTO, and E-commerce) involves setting up automated systems to calculate, collect, and remit sales tax efficiently. Here’s a comprehensive guide to achieve this in the near future:

Integrating Instant Sales Tax Remuneration and Reporting in QBO

1. Enable and Configure Sales Tax in QBO

- Enable Sales Tax:

- Navigate to the Taxes section in QBO.

- Set up your sales tax preferences, including adding all relevant state, county, and city tax agencies.

- Set Up Tax Rates:

- Ensure that the sales tax rates are configured correctly for each jurisdiction.

- QBO offers automatic tax rate updates, but verify these regularly to maintain accuracy.

2. Integration with Sales Channels

- POS Systems:

- Integration: Ensure your POS system integrates with QBO. Systems like Square, Clover, and Shopify POS offer direct integration.

- Tax Calculation: Configure your POS to calculate sales tax based on transaction location and sync it with QBO.

- MOTO Transactions:

- Manual Entry: Use QBO to manually enter sales orders and ensure the correct sales tax is applied.

- CRM Integration: Integrate with CRM or order management systems that sync with QBO for automated tax calculations.

- E-commerce Platforms:

- Integration: Connect your e-commerce platform (Shopify, WooCommerce, etc.) with QBO.

- Tax Calculation: Configure the platform to calculate and collect the correct sales tax based on the shipping address.

3. Instant Sales Tax Remittance

- API Integration:

- API Access: Obtain API keys and necessary credentials from your financial institution or FedNow.

- Integration: Use QBO’s API capabilities to integrate with state tax agencies for real-time tax remittance.

- Payment Gateways:

- Configure your payment gateways to remit collected taxes to state agencies instantly or on a predefined schedule.

4. Automated Sales Tax Reporting

- Real-Time Reporting:

- Set Up Reports: Configure QBO to generate real-time sales tax reports for each transaction.

- Integration with Tax Agencies: Use APIs or third-party services like Avalara or TaxJar to automate reporting and filing with state tax agencies.

- Scheduled Reporting:

- Automate Filing: Schedule automated sales tax filings through QBO or integrated third-party services to ensure compliance with reporting deadlines.

5. Compliance and Audit Preparation

- Regular Audits:

- Conduct regular audits within QBO to ensure all transactions are accurately recorded and taxes are remitted correctly.

- Maintain detailed records of all sales and tax remittances for compliance and audit purposes.

- Stay Updated:

- Regularly check for updates in sales tax regulations in the states you operate.

- Ensure QBO and any integrated systems are updated accordingly to remain compliant.

Example Workflow for Instant Sales Tax Remuneration

- POS Sale:

- A customer makes a purchase at your store.

- The POS system calculates the applicable sales tax and records the transaction in QBO.

- Sales tax is instantly calculated and marked for remittance.

- MOTO Sale:

- A customer places an order over the phone.

- The order management system calculates the sales tax and syncs the transaction with QBO.

- Sales tax is earmarked for real-time remittance.

- E-commerce Sale:

- A customer makes an online purchase.

- The e-commerce platform calculates the sales tax based on the shipping address and syncs the transaction with QBO.

- Sales tax is prepared for immediate remittance.

- Real-Time Remittance:

- The sales tax is automatically remitted to the appropriate state tax agency using API integration.

- QBO updates its records in real-time to reflect the remittance.

- Automated Reporting:

- QBO generates real-time sales tax reports, which are sent to the relevant state agencies.

- Scheduled reports ensure all tax obligations are met without manual intervention.

Benefits

- Efficiency: Automates tax calculation, collection, and remittance, reducing manual workload.

- Compliance: Ensures accurate and timely tax payments, minimizing the risk of penalties.

- Accuracy: Real-time updates and integrations reduce errors in tax reporting and remittance.

- Transparency: Detailed records and automated reporting provide clear audit trails for compliance purposes.

By implementing these steps, you can streamline your sales tax remuneration and reporting processes across POS, MOTO, and e-commerce channels, ensuring compliance and improving operational efficiency.

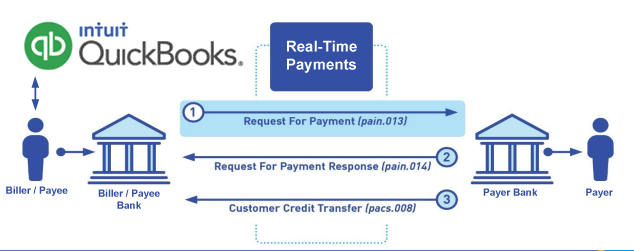

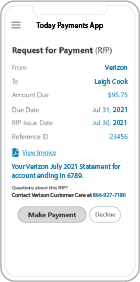

Call us, the .csv, text messaging and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) show how to implement Create Real-Time Payments Request for Payment File up front delivering message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continuing through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Call us, the .csv, text messaging and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) show how to implement Create Real-Time Payments Request for Payment File up front delivering message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continuing through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Our in-house QuickBooks payments experts are standing ready to help you make an informed decision to move your company's payment processing forward.

Pricing with our Request For Payment Professionals

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our Instant Sales Tax system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.